Myanmar-China Oil and Gas Pipeline Projects

DRKB1A Sino-Burma oil and natural gas pipelines in Burma linking Burmese deep water ports and Kunming, China

Myanmar-China Oil and Gas Pipeline Projects

The Myanmar-China Oil and Gas Pipeline projects began in 2010 with the aim of transporting natural gas and crude oil from the West coast of Myanmar to China. Both pipelines, which extend into China’s Yunnan Province, are part of a series of Chinese-built and operated infrastructure projects in Myanmar. By October 2013 and 2017 respectively, the two pipelines were fully operational and began moving natural gas extracted from Myanmar as well as energy imports from the Middle East and other fossil-fuel producing nations. These projects were heralded as ‘pioneer projects’ of the Belt and Road Initiative (BRI), and referred to as part of the China-Myanmar Economic Corridor (CMEC), despite the fact that these projects were completed prior to the formal announcement of both the BRI and CMEC in 2013 and 2017.

Project Background

China’s interest in Myanmar was driven by its hope to ensure its resilience in securing its energy supply routes, foster development in its lagging inland province, and boost its geostrategic position. Classified as one of the vital components of the BRI and CMEC, the Myanmar Oil and Gas Pipeline Projects—along with several other infrastructure and development projects in Myanmar—also hope to address the “Malacca dilemma”. By bypassing the Malacca straits which may be blocked by enemy navies in times of conflict, the oil and gas pipelines in Myanmar allow for an alternative route in acquiring China’s much needed energy-resources.

The gas pipelines transport gas from the Block A-1 and A-3 Shwe Gas field in the Bay of Bengal in Western Myanmar to the Yunnan Province in China. On its common route towards Ruili, the crude oil pipelines converge and run parallel to the gas pipelines from Kyaukphyu on the western coast of Myanmar. The length of the gas pipeline in Myanmar is 793km. The pipelines were completed in June 2013 and began operations in October 2013.

The crude oil pipelines stretch from the Madae Island of Rakhine State to Ruili, Yunnan Province. These pipelines are 771km in length: 770.5km of its total length runs through Myanmar and has the capacity to transport 22 million tonnes of oil, which accounts for 5% of China’s daily import demand. The crude oil pipelines were completed in 2014, but due to major issues relating to the negotiations of transport tariffs and imported oil tax, it only commenced operations in 2017.

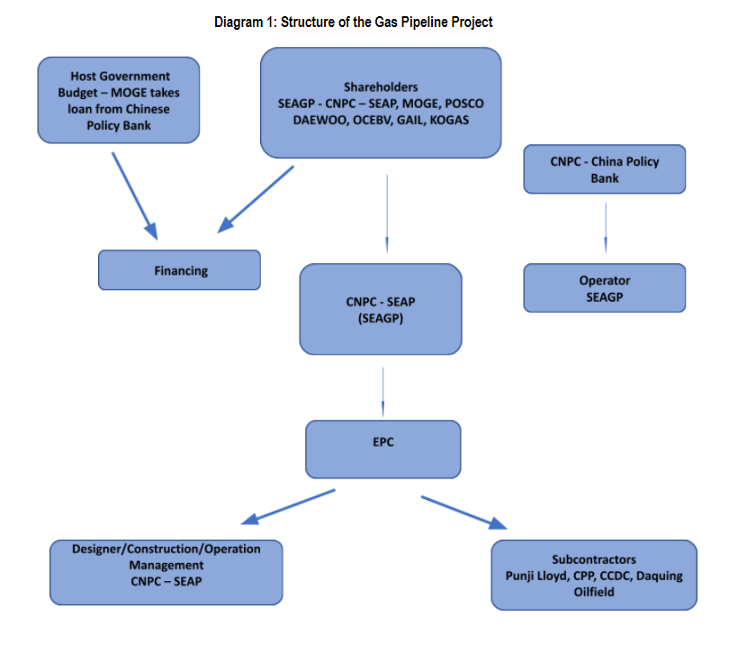

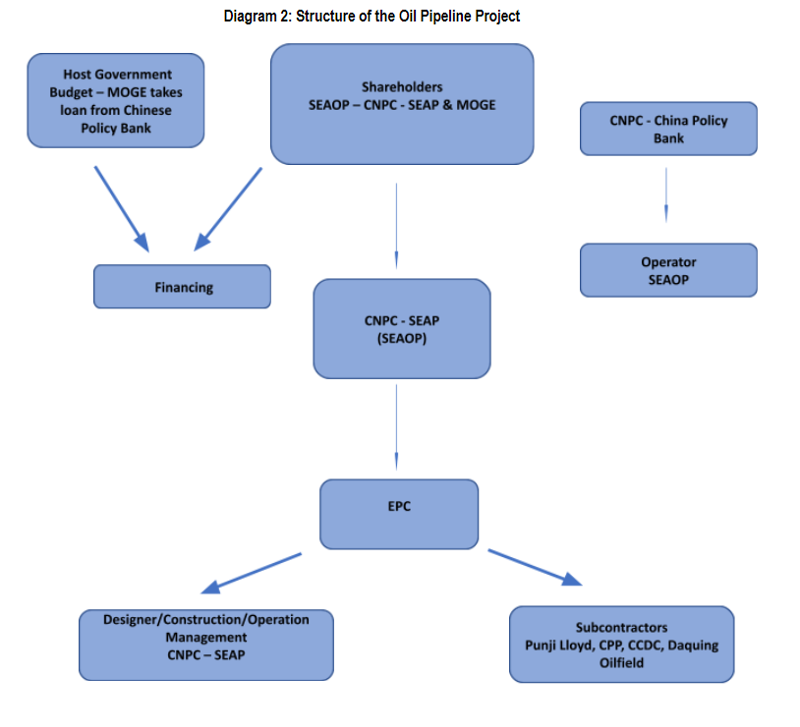

The Myanmar-China Oil and Gas Pipelines Project is primarily run by two special purpose vehicles (SPV) between Myanmar’s state-owned enterprise, the Myanmar Oil and Gas Enterprise (MOGE) and China’s state-owned enterprise, the China National Petroleum Corporation (CNPC).

Myanmar’s Foreign Investment Law (2012) states that any foreign company that wants to work in the oil and gas sector must enter into a joint venture (JV) with MOGE or a private Myanmar company. Therefore, the oil pipelines project is a JV between MOGE and the South-East Asia Crude Oil Pipeline Company Limited (SEAOP), a subsidiary of CNPC. CNPC owns 50.9 percent of the SEAOP shares, while MOGE holds 49.1 percent.

The gas pipelines, on the other hand, have an SPV consisting of the MOGE and five other foreign companies called the Southeast Asia Gas Pipeline Company Limited (SEAGP). These five companies are: the Korea Gas Corporation (KOGAS), the Korean POSCO Daewoo International Corporation (Daewoo), Indian-owned ONGC CASPIAN E&P B.V., GAIL India Ltd., and the South-East Asia Gas Pipeline Company Ltd. (SEAP), a Hong Kong-based company owned by CNPC. The Myanmar government’s MOGE only owns 7.365 percent of total shares in the SPV, while the Chinese-owned CNPC-SEAP is the major shareholder and can make final decisions as the operator. SEAP is a major investor in both SPVs for the pipeline projects.

The estimated funding for these projects stands at USD 2.54 billion, where USD 2.3 billion was allocated for the oil pipelines, and USD 2 billion for the gas pipelines. According to the Myanmar Extractive Industries Transparency Initiative (EITI) report for 2017 to 2018, MOGE took several loans from the China Development Bank (CBD) at a 4.5% interest rate in November 2010. As of 31 March 2018, the outstanding CDB loan balance for the gas pipeline was USD 1 billion and USD 88.7 million for the oil pipeline. Sources for the remaining funding remain unclear.

Feasibility, Political Capture and Corruption

The feasibility of these projects has been called into question, as Myanmar is now burdened with a huge amount of debt due to the pipeline constructions. The high interest rate (4.5%), which is among the highest in Myanmar’s bilateral loans, makes repayment a challenge. The risk is especially high as Western sanctions against Myanmar have further exacerbated the country’s dependence on Chinese investment, which could allow Chinese lenders to set higher rates.

Political capture in this project is not as evident as the issue of corruption. During the military rule, corrupt officials misused their powers to unfairly acquire lands from farmers which were more than what was required for the construction despite the existing land acquisition laws. On environmental impacts, these projects had improper waste disposal and construction activities—partly resulting from the land grabbing practices of corrupt officials—causing environmental degradation, flooding and soil erosion along the pipelines.

Lack of public disclosure of SOE revenues

The first Myanmar Extractive Industries Transparency Initiative (EITI) report in 2015 indicated that more than 50 percent of revenues collected were kept in separate “Other Accounts” (OAs) shielded from public scrutiny instead of being transferred to the state budget. These OAs were namely Union Fund Accounts (UFA-OAs), separate bank accounts to retain a portion of net profits created in 2013 under General Thein Sein’s government. Like other SOEs, MOGE also has OAs and operates with its own funding. In the fiscal year of 2017–2018, MOGE transferred about USD 504 million into these “Other Accounts.” OAs were meant to be abolished by the cabinet directive issued in June 2019. This directive required SOEs to transfer all of their OA balances to Union Budget Fund Accounts for priority expenditure items (such as health and education) and close their OAs, but as of 2020, MOGE’s OAs are still in use.

Lack of Public information regarding concessional contracts

In 2016, MOGE started to disclose some of the information on the pipeline projects, such as total production figures for each offshore field, crude oil and gas volumes for export and domestic use, production sites currently under production sharing contracts, and companies engaged. However, detailed information on the terms and conditions of concessional contracts, such as block numbers, operator names, country of origin, activities (study period, exploration, and production), Myanmar Investment Commission (MIC) permit numbers, commencement and expiry dates, company statuses (active/pending), locations, and share interest percentages, are currently not publicly available.

Weak Regulatory System

Although formal supervisory institutions exist in Myanmar, they do not have the legal mandates and resources to subject SOEs to proper checks and balances. Instead, relevant ministries play both a regulator and an implementer role: the ministries regulate industries while also carrying out projects using the SOEs under their control. This means that while ministries act as the nation’s regulatory institutions, they also act as the operating agencies of SOEs and hold overlapping roles and responsibilities, since they are the owners. This creates a conflict of interest: as SOE managers are free to sign concession contracts, they exercise broad discretionary power in signing concessional agreements, making them the gatekeepers to natural resources for foreign investors.

To capture different practices, quality and level of transparency, researchers are asked to answer six related questions for each data point. 1 point is assigned for each question to which the answer is “yes.” Each data point therefore has a total score between 0 and 6, where “0” means no information was publicly available at the time of research (not transparent) and “6” means full transparency.

| Project & Contract Phase | Project Information | Score | Response | Link to Information |

|---|---|---|---|---|

| Project Identification | Project owner | Myanmar Oil and Gas Enterprise (MOGE), Ministry of Electricity and Energy, Myanmar/ China National Petroleum Corporation (CNPC) | https://www.cnpc.com.cn/en/myanmarcsr/201407/f115a1cc6cdb4700b55def91a0d11d03/files/dec09c5452ec4d2ba36ee33a8efd4314.pdf | |

| Sector, subsector | Extractive Industry: Energy | https://www.cnpc.com.cn/en/myanmarcsr/201407/f115a1cc6cdb4700b55def91a0d11d03/files/dec09c5452ec4d2ba36ee33a8efd4314.pdf | ||

| Project name | Myanmar Oil and Gas Pipelines | https://www.cnpc.com.cn/en/myanmarcsr/201407/f115a1cc6cdb4700b55def91a0d11d03/files/dec09c5452ec4d2ba36ee33a8efd4314.pdf | ||

| Project Location | The 771-kilometer long pipeline extends from Madè Island on the west coast of Myanmar to Ruili in the southwestern Chinese province of Yunnan, running through Rakhine State, Magwe Region, Mandalay Region, and Shan State. | https://www.cnpc.com.cn/en/myanmarcsr/201407/f115a1cc6cdb4700b55def91a0d11d03/files/dec09c5452ec4d2ba36ee33a8efd4314.pdf | ||

| Purpose | ● To promote the economic development and to improve the living standard of people in Myanmar. ● To help solve the energy needs of Myanmar. |

https://www.euro-petrole.com/myanmar-section-of-myanmar-china-oil-and-gas-pipeline-starts-welding-n-i-5412 | ||

| Project description | https://www.banktrack.org/download/corridor_of_power_china_s_trans_burma_oil_and_gas_pipelines/corridor_of_power_sgm_sept_09.pdf | |||

| Project Preparation | Project Scope (main output) | 2,800 km natural gas pipeline, with an annual transportation capacity of 12 billion cubic meters, will transport the gas to Nanning in southwestern China. 1,100 km oil pipeline to Kunming with a possible extension to Chongqing with an annual transportation capacity of 22 million tons or 442,000 barrels per day. | https://www.mmtimes.com/national-news/25676-myanmar-and-china-sign-crude-oil-pipeline-agreement.html | |

| Environmental impact | Human rights violations and environmental destruction along a pipeline route fifteen times longer than the country’s existing natural gas pipeline to Thailand endanger the security and livelihoods of hundreds of thousands living in the corridor area. Sea-based sources of pollution by oil spills from tanker, traffic, and from oil exploration and production, threaten the healthy and largely intact ecosystem of the Rakhine coast and living marine resources and habitats in the Bay of Bengal. There are several environmental dangers involved in the commercial production and transport of natural gas including the leakage of chenicals used in the drilling process as well as potential gas blowouts. Once they reach the seabed, drilling wastes that include volatile organic compounds rob the water and bottom sediments of oxygen and as a result kill large proportions of life on the ocean floor, including shellfish beds. Toxic brine generated in the exploration process is also often dumped on or offshore. | https://earthrights.org/wp-content/uploads/the-burma-china-pipelines.pdf https://www.cnpc.com.cn/en/CaringforcommunitiesalongtheMyanmarChinaOilGasPipelines/CaringforcommunitiesalongtheMyanmarChinaOilGasPipelines.shtml | ||

| Land and settlement impact | Pipeline pass 700 km in Myanmar from Rakhine State to border of China, People living along pipeline areas in Rakhine State, Magwe, Mandalay Regions and Shan State have faced loss of land and livelihood, profiteering & corruption, damaged and destroyed land impacts, high environmental impacts. | https://earthrights.org/wp-content/uploads/the-burma-china-pipelines.pdf https://www.cnpc.com.cn/en/CaringforcommunitiesalongtheMyanmarChinaOilGasPipelines/CaringforcommunitiesalongtheMyanmarChinaOilGasPipelines.shtml | ||

| Contact details | Yangon-Mandalay Highway Near By 363/4 Mile-Brick, Mit Neg Post Office, Ta Yet Tan Village, Amarapura Township, Mandalay Division [email protected] |

https://www.seagp.biz/contact/ | ||

| Funding sources | CNPC Southeast Asia Pipeline Co., Ltd. (CNPC-SEAP) | https://www.cnpc.com.cn/en/myanmarcsr/201407/f115a1cc6cdb4700b55def91a0d11d03/files/dec09c5452ec4d2ba36ee33a8efd4314.pdf | ||

| Project Budget | The gas pipeline is scheduled for completion in March 2013 at a cost of approximately $1.04 billion. South-East Asia Pipeline Company Limited (SEAP), a Hong Kong registered entity created by CNPC, and the Shwe Consortium members, construct and operate the onshore pipeline. The CNPC controls a 50.9% stake (estimated construction costs of US$ 1.5 billion) in the oil pipeline through its wholly owned subsidiary South-East Asia Crude Oil Pipeline Ltd. (SEACOP) and Myanmar’s state-owned MOGE controls the remaining 49.1%. | https://earthrights.org/wp-content/uploads/the-burma-china-pipelines.pdf | ||

| Project budget approval date | March 2009, Gas Pipeline & June, 2009, Oil Pipeline, Myanmar section started in 2010. | https://www.cnpc.com.cn/en/CaringforcommunitiesalongtheMyanmarChinaOilGasPipelines/CaringforcommunitiesalongtheMyanmarChinaOilGasPipelines.shtml | ||

| Project Completion | Project status (current) | Completed and operational | https://www.gem.wiki/Sino-Myanmar_Gas_Pipeline | |

| Completion cost (projected) | US$1.5 billion oil pipeline and US$1.04 billion natural gas pipeline | https://earthrights.org/wp-content/uploads/the-burma-china-pipelines.pdf | ||

| Completion date (projected) | July 18th, 2013 Gas pipeline April 10th, 2014 Crude Oil pipeline |

https://www.gem.wiki/Sino-Myanmar_Gas_Pipeline#Project_Details |

||

| Scope at completion | Projected and completion – no change | https://www.cnpc.com.cn/en/myanmarcsr/201407/f115a1cc6cdb4700b55def91a0d11d03/files/dec09c5452ec4d2ba36ee33a8efd4314.pdf | ||

| Reasons for project changes | Not available | |||

| Reference to audit and evaluation reports | Not available | |||

| Procurement | Procuring entity | Myanmar Oil and Gas Enterprise, Complex 44, Zeya Htarni Road, Naypyidaw, Myanmar | https://www.moee.gov.mm/en/ignite/page/11 | |

| Procuring entity contact details | 067 341 1055 | https://www.moee.gov.mm/en/ignite/page/11 | ||

| Procurement process | Direct Award | https://www.moee.gov.mm/en/ignite/page/407 | ||

| Contract type | Survey, Design, Construction and operation management | https://www.seagp.biz/who-we-are/ | ||

| Contract status (current) | Active | https://www.cnpc.com.cn/en/myanmarcsr/201407/f115a1cc6cdb4700b55def91a0d11d03/files/dec09c5452ec4d2ba36ee33a8efd4314.pdf | ||

| Number of firms tendering | Direct Award – Project started with a dialogue between China-Myanmar governments for feasibility. |

https://en.wikipedia.org/wiki/Sino-Myanmar_pipelines https://earthrights.org/blog/shwe-gas-project-in-burma-recent-developments/ |

||

| Cost estimate | The contract is not available. Estimated USD 2.5 Billion in wikilink but reuter USD 3.5 Billion |

https://en.wikipedia.org/wiki/Sino-Myanmar_pipelines#cite_note-bloomberg-16 https://www.reuters.com/article/us-china-myanmar-pipelines-idUSTRE6120MQ20100203 |

||

| Contract administration entity | Same | https://www.moee.gov.mm/en/ignite/page/11 | ||

| Contract title | Myanmar-China Oil and Gas Pipeline Project | https://www.cnpc.com.cn/en/myanmarcsr/201407/f115a1cc6cdb4700b55def91a0d11d03/files/dec09c5452ec4d2ba36ee33a8efd4314.pdf | ||

| Contract firm(s) | South-East Asia Gas Pipeline Company Limited (SEAP) | https://www.cnpc.com.cn/en/myanmarcsr/201407/f115a1cc6cdb4700b55def91a0d11d03/files/dec09c5452ec4d2ba36ee33a8efd4314.pdf | ||

| Contract price | USD | https://earthrights.org/wp-content/uploads/the-burma-china-pipelines.pdf | ||

| Contract scope of work | Not available | |||

| Contract start date and duration | Not available | |||

| Implementation | Variation to contract price | Not available | ||

| Escalation of contract price | Not available | |||

| Variation to contract duration | Not available | |||

| Variation to contract scope | Not available | |||

| Reasons for price changes | Not available | |||

| Reasons for scope & duration changes | Not available |